Having trouble dealing with the Financial hardships of Autism? You are so not alone, my friend. Autism is a life long diagnosis, so although needs will change over time, the financial hardships of autism will never completely dissipate.

If you are new to our blog, WELCOME!! We share lots of helpful advice from a mom who has been there and is still showing up every day. There are so many challenges and we tackle them one at a time. Please read about me here https://faithhealthautism.com/about-me/.

Overview of Autism Therapies

First of all, individuals on the autism spectrum ( which is quite vast) are exactly that. An individual. We are all different. Some need medical care for common long term issues such as seizure. Most need some type of speech, OT, PT and specialized education. These costs add up quickly. There are 2 specialized therapies especially designed for autism. The first is ABA ( Applied Behavior Analysis); the second is TEACCH which is a program based out University of North Carolina . You can read about TEACCH through the Autism Speaks website here https://www.autismspeaks.org/teacch-0, and about ABA therapy here https://www.autismspeaks.org/applied-behavior-analysis.

The issue with all of these on the financial side of life is that they are all expensive Really, really expensive. Our twins are in multiple therapies to help with communication and skills. We do not have any access to Medicaid dollars ( even though we pay our taxes for everyone else to have this), so we have to rely on private insurance through our work. Every thing else is out of pocket. You can watch a full video of this on our you tube channel, and I will attach the video here.

The Big Debt Pile UP

First, I know that most people acquire debt by buying things they cannot afford, but for us, almost all of our household/student debt is a result of the large financial burden of our therapies. And now that our life is fairly stable, it’s time to get rid of the debt. Second, long term financial freedom for our family is the only way to properly take care of our special needs kids and I am determined to get to that point.

I am about 5 months in to my debt repayment program, have several resources for this, and would like to share them with you.

Resources for Debt Repayment

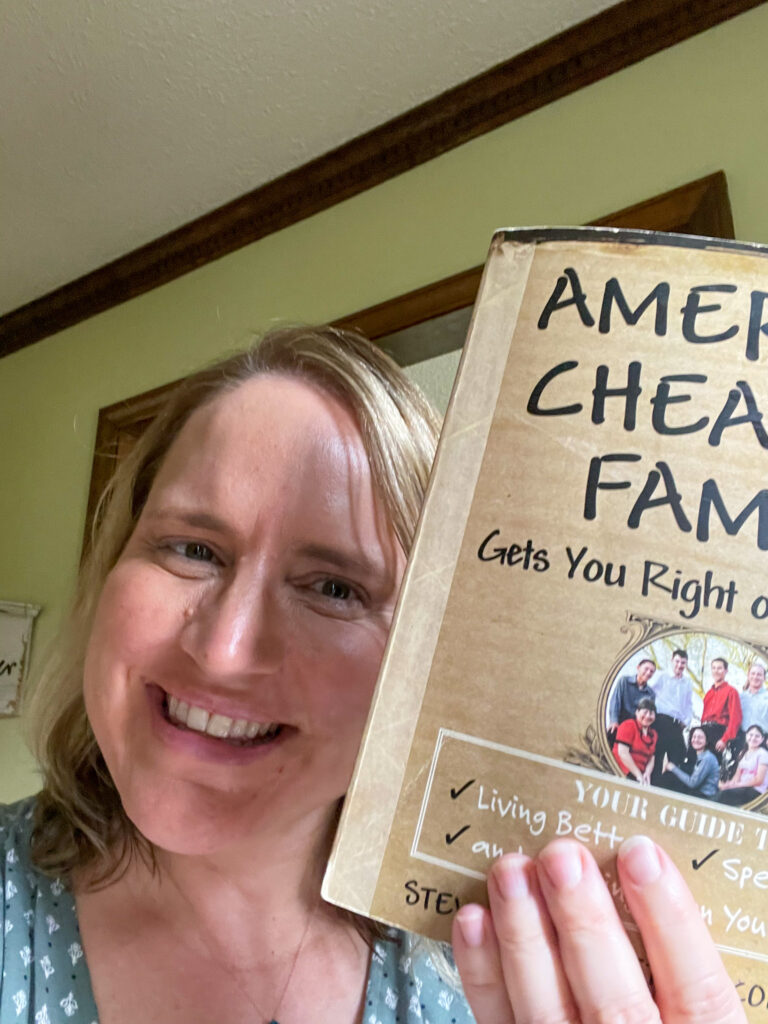

My favorite resource for debt resolution is the book America’s Cheapest Family Gets Your Right on the Money by Steve and Annette Economides ( that is their real name). I feel that the authors, who are a husband and wife team, are the most practical approach without all the heavy marketing schemes that other financial gurus are known for. They are just regular people like you am me, and I am pretty sure that is why I like them so much.

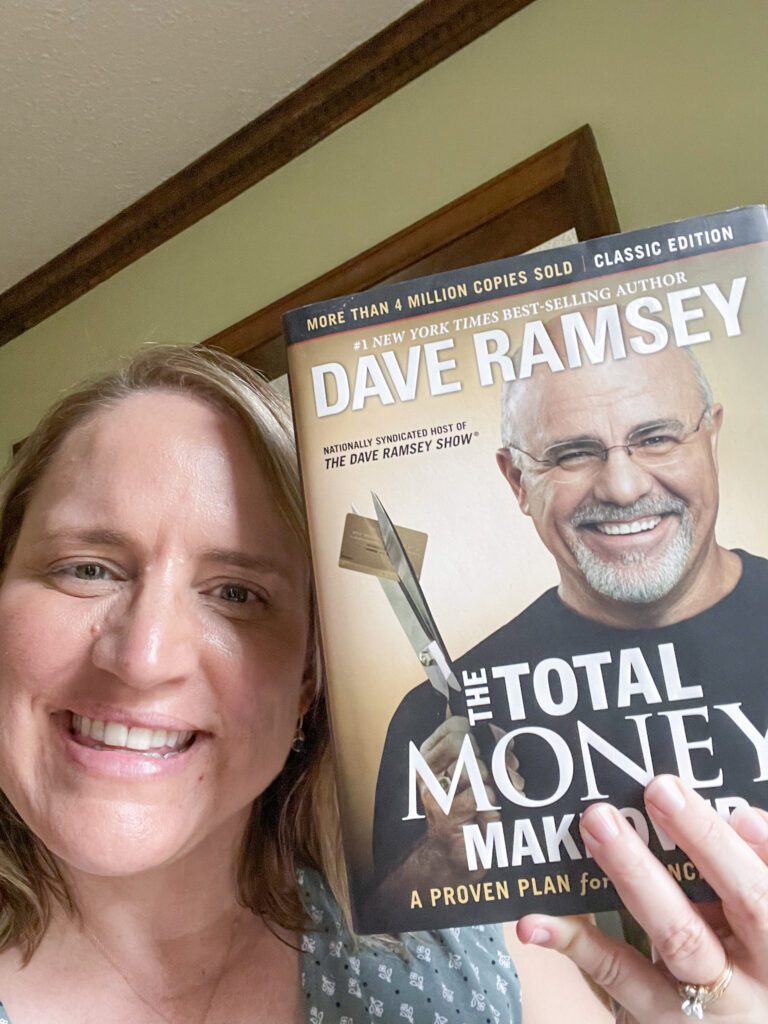

The second favorite resource is Dave Ramsey’s collection of books, including The Complete Money Makeover. I have at one point taken the Financial Peace University class at church. I find the baby steps #1 and #2 a little hard to accomplish, I explain fully in the video above. This plan does work, but the traditional baby step one needs most likely will need adjusting.

I do most of my banking online; however, for my budget I do prefer pencil and paper. It’s just a little old fashioned, but holding the budget in my hand seems to empower me. If you are younger ( most likely) and prefer to do everything electronically, there is a popular app called YNAB ( You need a budget) that seems to be used commonly on a smartphone. Here’s the link to YNAB https://www.youneedabudget.com/?utm_source=msn&utm_medium=cpc&utm_campaign=(roi)+branded&utm_content=you+need+a+budget&utm_term=you%20need%20a%20budget.

Work in Progress

The main reason for this particular post is to help you on your journey. Financial hardships with autism is a daunting part of every family’s struggle. And I want to encourage you by sharing my journey, which is currently a work in progress. I will be giving updates every single month and sharing on you tube and Instagram, Please follow along!

Leave a Reply